For years, the growth of Ferrari seemed almost unstoppable. More models, more deliveries, more sales. A linear trajectory that the Maranello-based brand carefully nurtured... until now. The official 2025 results confirm what our registration figures had already hinted at: Ferrari is experiencing a drop in sales. And yet, the brand has never made so much money. A paradox only in appearance.

Fewer cars, but more income

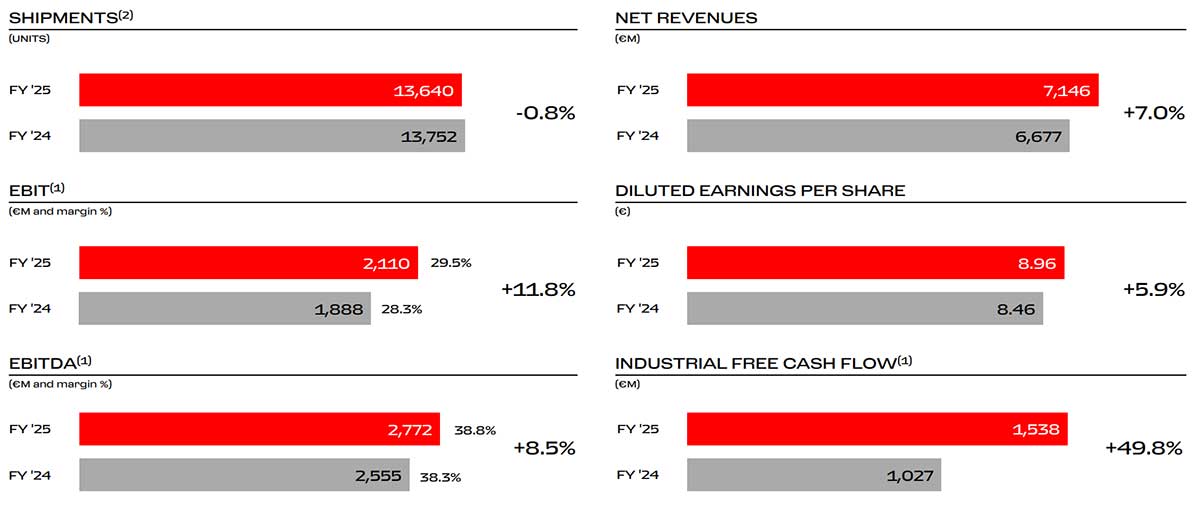

In 2025, Ferrari delivered 13,640 cars, compared with 13,752 in 2024. A slight drop, almost symbolic, but a significant break in a decade of continuous growth. In a conventional automotive industry, such a decline would immediately herald a drop in revenues. At Ferrari, the opposite is true.

Sales rose by 7 % to 7.15 billion euros. Operating profit climbed even faster: +12 %. Margin now stands at 29.5 %, an exceptional level even in the luxury sector. Ferrari earns more... by selling less. And this is no accident!

The F80, a real financial tool

The key is the F80. The 799-unit hypercar, priced from around 3.6 million euros each, alone represents several billion euros in potential revenues spread over several years. In fact, Ferrari has scheduled the first deliveries for 2025, exactly as planned. But the most important point is not the price, but the pace.

Ferrari would have deliberately chosen not to deliver this F80 too quickly. By staggering deliveries, you can smooth out income over time and cushion the impact of years with lower volumes. A hypercar thus becomes a genuine financial steering tool. In other words F80 is not just a showcase model. It's an economic stabilizer.

The new strategy: selling value, not volume

Benedetto Vigna has been repeating it for several months: Ferrari is no longer looking to break production records, but to increase the value of each car sold. The official press release confirms that the increase in results comes mainly from :

- a richer product mix

- customization

- racing and lifestyle activities

This is precisely why Ferrari opens new Tailor Made centers in Tokyo and Los Angeles. The aim is not to sell more Ferraris, but to sell much more expensive Ferraris. Each customer becomes almost a co-designer. Each car becomes almost unique. And every delivery pays off.

This strategy perfectly explains what we've been seeing on the markets over the past year: registrations are down slightly in the US and UK, and stagnating elsewhere... but financial health continues to improve. After the decade of quantitative growth comes the decade of qualitative growth. Fewer cars, more exclusive, more personalized, more profitable.

The future: even more profitable

Ferrari is already targeting revenues of around €7.5 billion for 2026, with margins still on the rise. Above all, the order book is full until the end of 2027. The message is clear: Ferrari is no longer really a car manufacturer. It is now an industrial luxury house capable of using its models - especially its limited-edition hypercars - as long-term financial instruments.

The F80 inaugurates a new logic: a Ferrari is no longer just for driving... it's also for driving results. And you can be sure that if Ferrari ever introduces a Ferrari F80 Spider, also produced in a limited edition and sold at full price, it will become a new financial tool for optimizing Ferrari's results for many years to come.