In 2025, Stellantis narrowly avoided a financial penalty that could have reached historic levels. Thanks to the last-minute easing of European rules on CO₂ emissions, the group escaped a a theoretical fine of over 800 million euros on the Italian market alone. Immediate relief, but misleading.

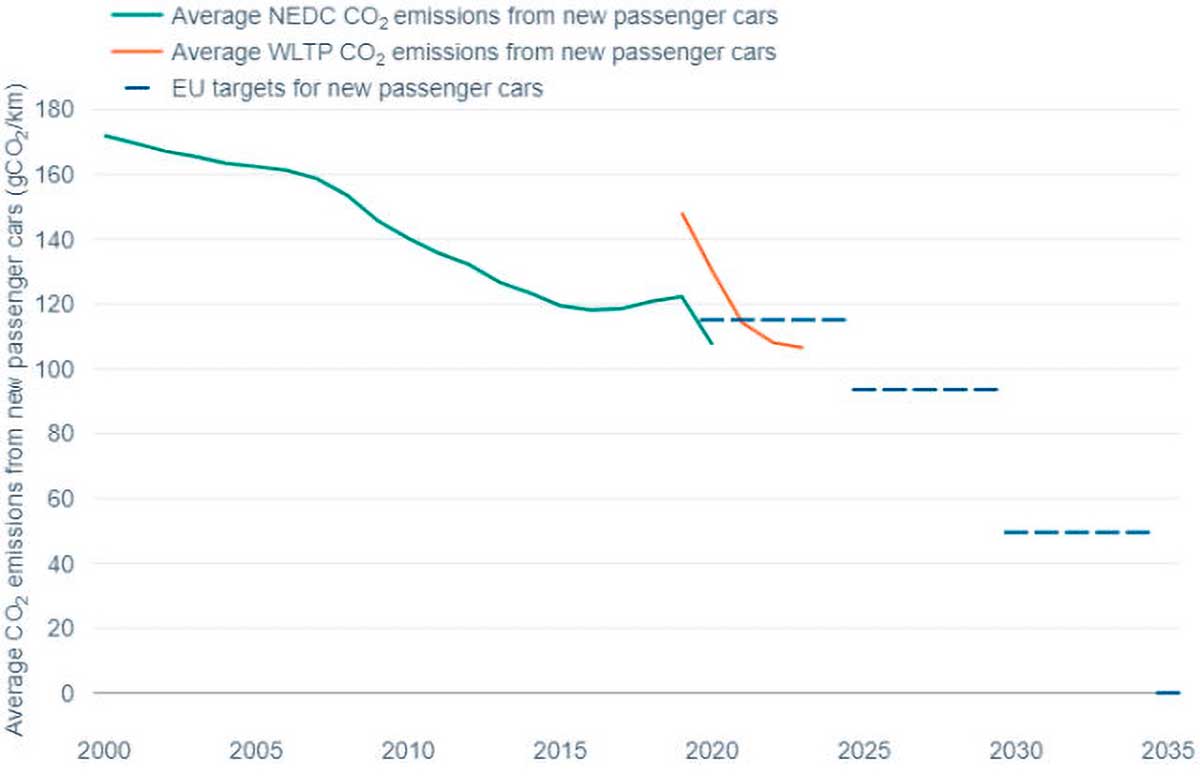

Because this decision by Brussels solves nothing of substance. It merely postpones the problem to 2026 and beyond, in a regulatory context that is set to become even tougher. The emissions thresholds imposed on automakers continue to fall, with a clearly defined trajectory: around 93.6 g/km from 2025, then a reduction of 55 % by 2030, i.e. a target average close to 49.5 g/km. In other words, a virtually unattainable level for a group whose volumes are still largely based on combustion and hybrid models.

Italy reveals European vulnerability

The recently published Dataforce study acts as an electroshock. Without regulatory flexibility, Stellantis would have accumulated over 800 million euros in penalties in Italy in 2025, including passenger cars and light commercial vehicles. Fiat, the Group's historic brand and mainstay on the peninsula, would have been the main contributor, ahead of Peugeot, Citroën, Jeep, Opel and even Alfa Romeo. And Italy is just a case in point. On a European scale, potential exposure is well in excess of a billion euros a year. Under these conditions, the equation becomes insoluble: even if Stellantis speeds up the electrification of its European ranges, it cannot, in the space of a few years, bring all its volumes below the thresholds required by CAFE regulations.

Leapmotor, more than just a Chinese partner

It's against this backdrop that Leapmotor's status is changing completely. Hitherto perceived as just another Chinese electric brand, Leapmotor is gradually becoming a major strategic tool for Stellantis in Europe. Already in 2025, its sales of 100 % electric vehicles enabled the group to generate around 70 million euros in CO₂ credits. Still a modest amount on the scale of the problem, but indicative of a far greater potential.

The decision to produce Leapmotor in Europe, and more specifically at the Stellantis plant in Zaragoza, Spain, changes the situation radically. This plant already assembles the Peugeot e-208, Opel e-Corsa and Lancia Ypsilon. The site's Line 2 is currently being adapted to accommodate up to 200,000 Leapmotor vehicles per year, with three shifts and a production rate of almost 950 cars per day. Four models are in the pipeline: the B10 from the end of 2026, followed by the B05 in 2027, then the A10 and A05 in the medium term. The ramp-up will be gradual: around 40,000 vehicles in the first full year, then a rapid doubling depending on the industrial trajectory and European demand. This local production makes Leapmotor eligible for national bonuses, reinforces its political acceptability... and above all, enables its volumes to be fully integrated into Stellantis' calculation of average emissions in Europe.

The calculation that could change everything for Stellantis

The mechanism of the CAFE law is implacable, but also mathematical. Each electric vehicle sold offsets the emission overruns of the group's other models. Keeping the current assumption of a penalty of 95 euros per gram of CO₂ above 94 g/km, the reasoning becomes crystal clear. With 200,000 electric Leapmotors registered over the course of a year, Stellantis could generate nearly 1.8 billion euros in CO₂ credits. A sum capable, on its own, of neutralizing the group's "poor performers", from Fiat to SUVs, via certain generalist brands still heavily dependent on combustion engines. Of course, we'll have to be patient. In 2027, with 40,000 units, the potential credit would be around 357 million euros. In 2028, with 80,000 vehicles, it would already be close to 700 million. But by 2030, if the Zaragoza plant is running at full capacity, the equation changes completely: Leapmotor could earn Stellantis almost 2 billion euros a year, not in direct sales, but in avoided penalties.

Saving Stellantis in Europe and its historic brands

This industrial gamble is backed by a solid commercial reality. In 2025, Leapmotor delivered almost 600,000 vehicles worldwide, more than double the previous year's figure. For 2026, the manufacturer is aiming for one million units, supported by an electric and hybrid range with aggressive pricing. For Stellantis, the interest is twofold. On the one hand, Leapmotor makes it possible to rapidly increase the share of zero-emission vehicles in Europe without waiting for internal platforms to fully mature. On the other, it acts as a financial buffer in the face of climate regulations that have become a major risk to profitability.

Basically, Leapmotor offers Stellantis a pragmatic solution to a structural problem. The Group cannot, in the short term, brutally transform Fiat, Alfa Romeo, Peugeot or Citroën into 100 % electric brands. All it has to do is offset their emissions with a massive volume of zero-emission vehicles produced and sold under another banner. It's this discreet but formidably effective trick that could enable Stellantis to pass the European regulatory hurdle until 2030. Not by winning the technological battle on all fronts, but by using Leapmotor as a financial and regulatory lever. A maneuver which, if confirmed, could well earn the group almost 2 billion euros a year, up to the next threshold of 2030.

This is a perfect illustration of the effects of forced-market decarbonization.

In the absence of consultation between legislators and manufacturers, the latter have been forced to open their doors wide to the Chinese Trojan horse.

Beyond this dangerous game of go, it is to be hoped that Stellantis will take advantage of this "partnership" to make technical progress and accelerate the electrification of its flagship brands.

Like the Chinese manufacturers Dongfeng, Geely and others, who in the 90s patiently learned to "shadow" the European manufacturers, led by VW and PSA, who came to "conquer" the promised Eldorado of the Chinese market.

Now the Chinese have a decisive advantage that we Europeans have never managed to achieve: speaking with one voice.

Fantastico! Cioè per evitare multe che ci siamo autoimposti non vendiamo più macchine fiat ma vendiamo auto cinesi. Una genialata! Abbiamo risolto il problema! Ops..ma qual'era lo scopo delle multe? Affossare l'industria europea mentre tutti nel mondo fanno come gli pare?

walgelijk dat boete nu over 3 jaar wordt bepaald. uitstootnormen waren al bekend 4 jaar geleden. europese auto producenten blijven hangen in conservatief denken. zelfs saoudi arabie gaat over naar hernieuwbare energie. en culturele hervormiming, vision 2030. stellantis maak ICE motoren blijven pushen. toyota haalt blijkbaar wel 94 gram co2 met heel hun auto vloot, europa wordt net wakker.