Stellantis is preparing to strike a major blow on the other side of the Atlantic. According to several sources close to the matter, the Italian-French-American group could announce in the coming weeks a new $5 billion investment plan in the United States, in addition to the $5 billion already planned. A total of $10 billion could therefore be injected over the next few years, mainly to modernize plants, relaunch idle sites, create jobs and introduce new models. Illinois and Michigan, two historic bastions of the American automotive industry, would be at the heart of this plan.

Why is Stellantis betting so heavily on the United States and not on Europe, the birthplace of such iconic brands as Fiat, Peugeot, Citroën, Alfa Romeo and Lancia?

Jeep, Dodge and Chrysler in the crosshairs

With this plan, Stellantis intends to relaunch its historic American brands. Jeep and Dodge remain highly profitable mainstays, and the group is even considering a comeback for Chrysler, with the idea of a new V8 muscle car or the reopening of the Belvidere (Illinois) plant. This site, currently inactive, could once again employ 1,500 workers to produce a new Ram pick-up, a strategic model in a market where pick-ups remain king.

This marks a break with the Carlos Tavares years, when the emphasis was on production in low-cost countries like Mexico and massive investment in electrification in Europe, a gamble that didn't prove as profitable as hoped.

Europe, a market under pressure

In Europe, Stellantis faces several obstacles:

- A less profitable market: despite more sales than in the United States, the margin per vehicle is much lower.

- Sluggish electrification: demand for electric cars remains weak, which delays projects and forces us to maintain combustion engine versions.

- A restrictive regulatory context: CO₂ standards, political pressure and uncertainties surrounding public aid complicate the strategy.

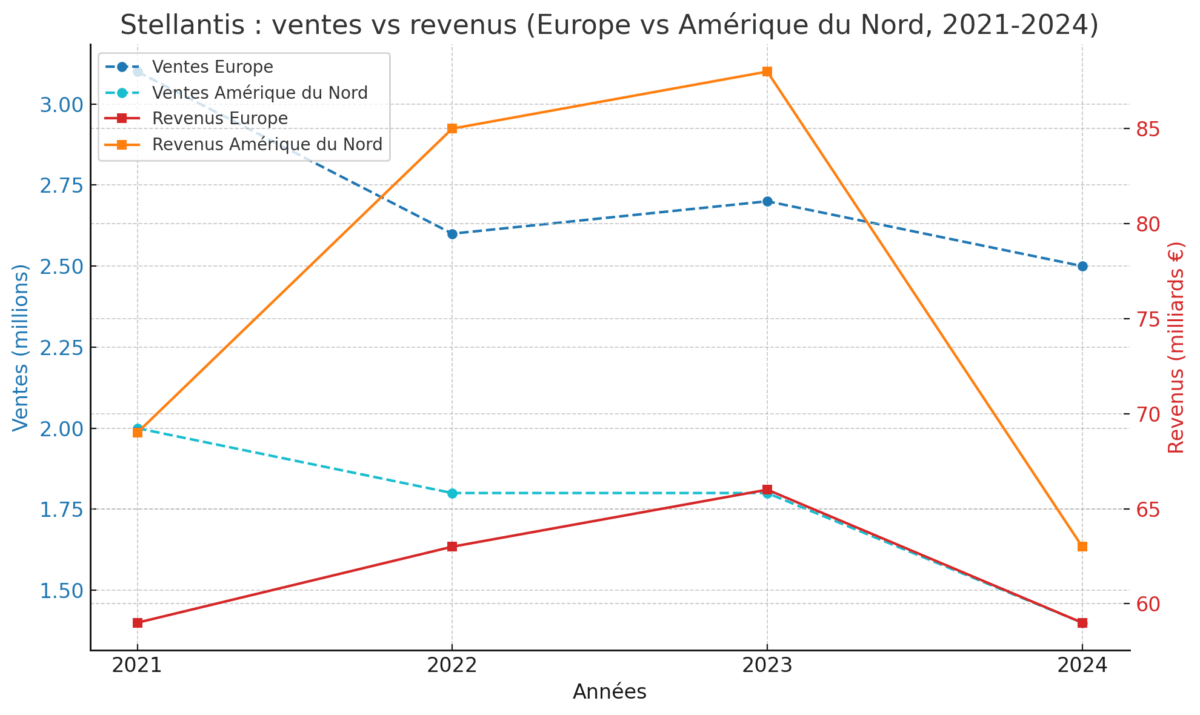

The proof is in the figures: in 2024, Stellantis sold 2.5 million cars in Europe (almost twice as many as in North America), with 126,800 employees, for sales of €59 billion. In North America, on the other hand, only 1.4 million cars sold and 75,500 employees, but sales of €63 billion. In other words, fewer cars, fewer employees, but more revenue.

Looking back over the past few years, the trend is even clearer: between 2021 and 2023, North American sales oscillated between €69 and €88 billion, well ahead of Europe.

An implacable logic

From a purely economic point of view, Stellantis is right to concentrate its efforts in the United States. The American market is the one with the highest margins, where pick-ups and SUVs sell at high prices, and where the revival of brands like Jeep and Dodge can pay off handsomely.

Conversely, in Europe, regulatory pressure, higher wage costs and the forced transition to electric power are reducing profitability prospects. If Stellantis wants to regain its €80-90 billion annual sales in North America, investing €10 billion $ in this strategic market is a pragmatic decision.

A new era with Antonio Filosa

Under the leadership of its new CEO, Antonio Filosa, Stellantis is preparing a global industrial plan expected by the first quarter of 2026. The latter has already initiated a thorough review of strategy, cutting back on certain projects deemed non-strategic in Europe, such as hydrogen, and considering the sale of Free2move, the ailing car-sharing subsidiary. The message is clear: from now on, the Group will choose its battles. And the United States appears to be the most profitable playground.

Well, as a good son of Merchione, he's going to do the same ... America is easy money and Europe and Italy (France too, of course) can go and complain to the governments. Economic logic above all

As they say, this is America.

Made in US, Back Again! V8s and muscle cars are back with a vengeance!

But what's planned to relaunch Maserati in the US? The Trident's renaissance absolutely depends on this key market.

Verissimo, hanno messo gente sbagliata negli USA, ora possono ricominciare. Il problema è che adesso mancano i prodotti, le Maserati attuali sono vecchissime ed hanno speso poco anche con il design.

My next car will be built in Europe, that's for sure. We'll see if Stellantis offers a suitable product.

"Higher wage costs" in Europe than in North America? I have my doubts. Wages in the USA or Canada are often (much) higher.

It's not a cost per head but on the mass. They have fewer employees in the US, but make more sales there.

Non ci sono solo i salari, ma anche i costi energetici e la tassazione imprese che in USA sono più bassi.

Well, that's mainly because Europe has the euro, so to invest dollars you have to go to the US...