When the Peugeot family was torn apart over the question of his future influence within Stellantisthe outcome still seemed uncertain. On one side, Robert Peugeot, the embodiment of continuity and architect of the merger between PSA and Fiat Chrysler Automobiles. On the other, Xavier Peugeot, head of DS Automobiles, with a more offensive line aimed at restoring industrial and strategic weight to the French branch. After several weeks of internal discussions, the dynasty has finally put an end to the suspense: Robert Peugeot will be reappointed to the Board of Directors of DS Automobiles. Stellantis for a final two-year term.

A family duel becomes a strategic challenge

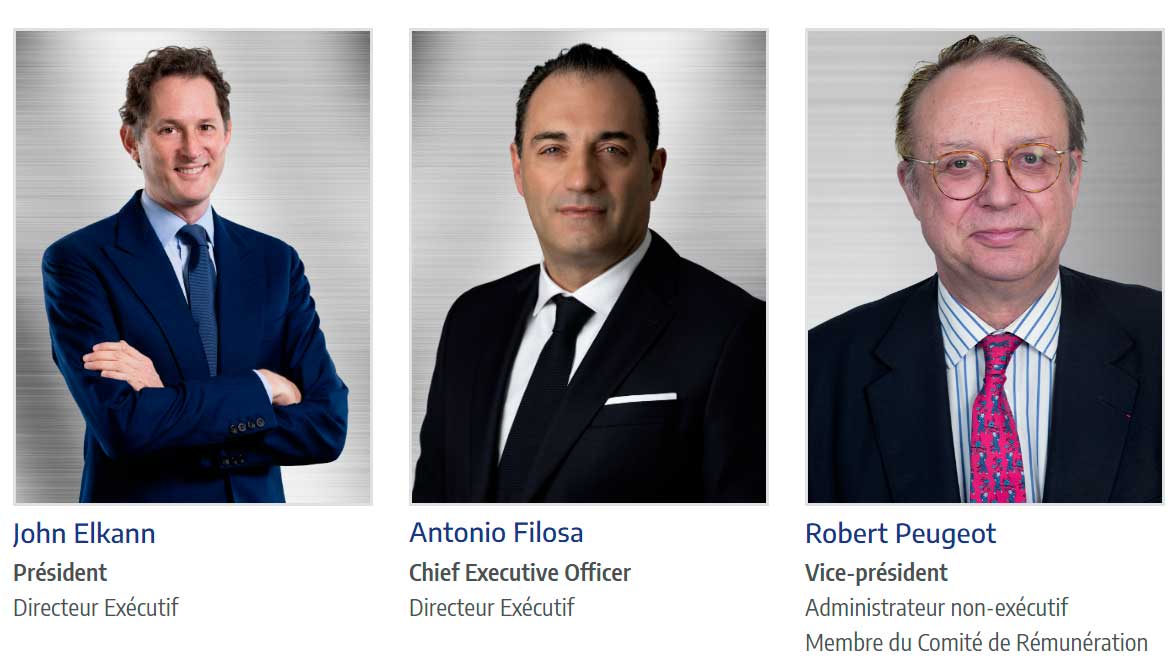

This choice, endorsed by the various family holdings, is not simply a renewal of a mandate. It marks the conclusion of a quiet but real duel between two visions of the future. At the age of 75, Robert Peugeot will continue to serve on the Board of Directors, where he will continue to hold the position of Vice-Chairman alongside John Elkann, Chairman of the Board and representative of the Agnelli family.

Opposite him, 60-year-old Xavier Peugeot hoped to embody a new phase for the Peugeots within the world's fourth-largest automotive group. His project was based on a more political reading of Stellantis' governance, at a time when the Group's center of gravity seems to be shifting ever more towards an Italian-American axis, reinforced since the arrival of Antonio Filosa as CEO.

Continuity as a guiding principle

In choosing Robert Peugeot, the family has clearly opted for stability. The patriarch can point to a track record considered decisive by part of the clan: the success of the PSA-FCA merger, several years of high dividends under Carlos Tavares, and smooth governance in a group that has become sprawling. For his supporters, it would have been risky to call this balance into question in a context already marked by a difficult year for Stellantis. This final two-year mandate, which will be officially validated at the Annual General Meeting in 2026, nevertheless marks a form of transition. The Peugeot family was keen to reiterate its long-term commitment to Stellantis, while acknowledging the move to shorter terms as a sign of increased vigilance over the Group's governance.

French influence under pressure

With nearly 8 % of the capital, the Peugeots remain Stellantis' second-largest shareholder, far behind Exor and its more than 15 %. This position mechanically limits their ability to weigh up against the Agnelli family, especially as the status quo agreement resulting from the 2021 merger prevents any rapid increase in capital before 2028. It was precisely on this point that Xavier Peugeot and his brother Thierry had tried to open the debate. Their conviction: the family should have taken advantage of the boom years to strengthen its stake and, potentially, claim a second seat on the board. This option has now been ruled out, as Peugeot Invest still favors a diversification strategy rather than a refocusing on the automotive sector.

The retention of Robert Peugeot also sends a clear message to Antonio Filosa and the ex-FCA management team. At this stage, the Peugeot family is not seeking to regain control of the Group's operational direction. It implicitly accepts the new dynamic impelled from Turin and Detroit, while retaining a balanced role on the Board. It remains to be seen how Robert Peugeot will use these last two years. Will it be a transitional mandate, aimed at preparing a consensual succession, or a period during which the family will attempt to discreetly redefine its strategy of influence? At a time when Stellantis needs to clarify its industrial choices, the question remains open.

That way, in 2 years' time, we'll be able to say goodbye to DS, which won't be a loss.

Peugeot's influence is far too great with PureTech and platforms.

We'd like it all to go away.

Why is this a big story a big deal? Peugeot doesn't sell in the state's Stellantis. Those Italian cars don't sell in America. Please sell Dodge, RAM and Jeeps back to the USA.

Because you may not know that Stellantis is a merger between FCA (Italy, Elkann family) and PSA (France, Peugeot family). Even though the Peugeot, Citroën, and DS brands are not present in the US, these two families are majority shareholders in Stellantis and sit on the board of directors.

Agnelli family would be more logical 😉

And thank you for pointing out that it's the Italians and the French who are the majority shareholders in the group (the American brands are just properties).

Dodge with european platform (STLA Large). RAM with FIAT rebranded cars (Promaster, PM City, PM Rapid, 700, Rampage,...).

Fatal wäre nur wenn sie Alfa Romeo kaputt machen würden, ich hoffe dass dem J.Elkan was gutes einfällt dafür, Tradition seit 1911, VW 1930er Jahre und ein Massenprodukt,Audi ebenso beide verdienen aber kein Geld mit ihren Karossen.

Former CEO was French's appointment and was a complete disater for the company ( although very good for shareholders who bleed out the company ). With new CEO , a FCA guy , company is trying to remember that they are a car company. Huge investment in US and South America.

Tavares ha rovinato molte famiglie.il suo amico sta rovinando la Ferrari.so che un Dio esiste.e in partenza un razzo su Marte.solo loro due.....

I've been watching the company closely since the merger and it appears the Corporation is actively bleeding the American manufacturing plants dry while demanding unrealistic expectations. This is looking like DaimlerChrysler all over again.

I suspect you may be correct. Stellantis should drop DS, drop Lancia (if not already killed off), invest more in Peugeot & in Alfa Romeo- especially in New designs/ models. Peugeot needs more & better commercial vehicles to compete against Ford in UK & Françe/Belgium & Netherlands. It is a mistake to keep too many brands alive against Chineses state subsidised electric cars.