When Stellantis was born in 2021 from the merger between PSA and Fiat Chrysler Automobiles, everything was based on an architecture designed to maintain a Franco-Italian balance. Five directors from the Peugeot orbit and five from the Agnelli side were to guarantee stable governance, while former PSA boss Carlos Tavares was given a five-year term as CEO. This apparently solid symmetry began to crack in December 2024 with Tavares' early resignationwho was supposed to stay until 2026 before retiring.

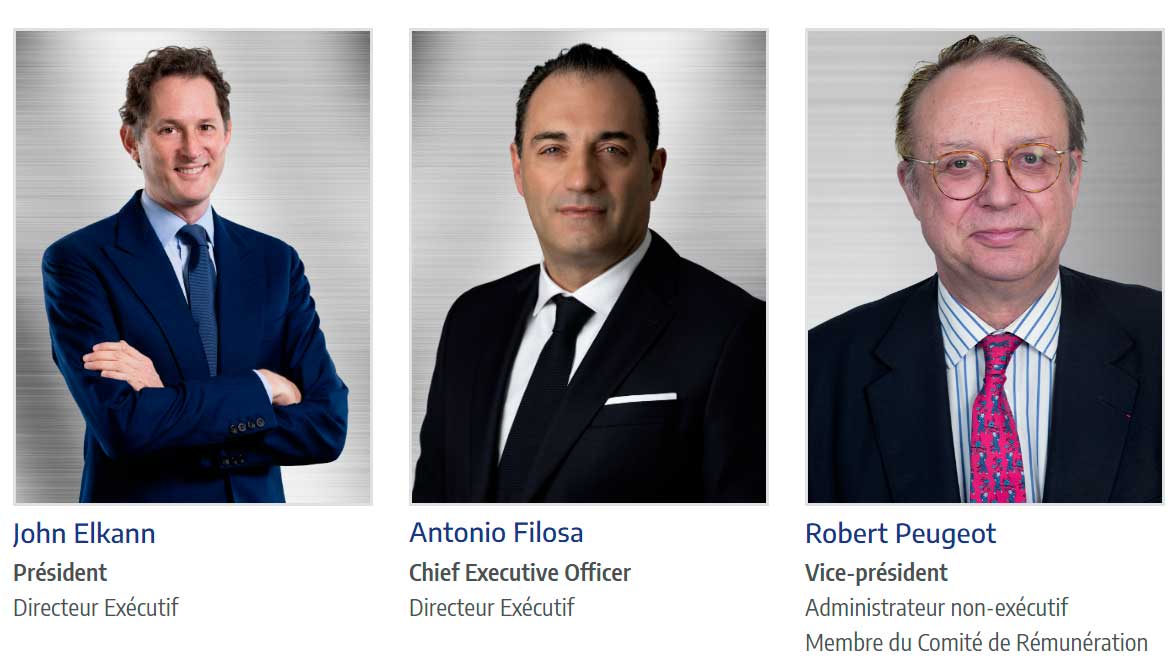

Since June 2025, Stellantis has been headed by Antonio Filosa, a figure from the former FCA, supported at the time by Robert Peugeot himself. But this shift towards Italo-American leadership has profoundly altered the internal balance and rekindled a growing concern on the French side: that of seeing Peugeot's influence in the world's fourth-largest automotive group diminish with each passing year.

One chair, two heirs and a family rift

Tension is now palpable within the dynasty. Before the end of 2025, the three family holdings - Établissements Peugeot Frères, Peugeot Invest and Peugeot 1810 - must appoint a single representative to the Stellantis Board of Directors. This seat, currently occupied by Robert Peugeot, has become the symbol of a strategic confrontation between two opposing visions: that of the elder Robert, loyal architect of the PSA-FCA merger, and that of his cousin Xavier, head of DS and the last family member still directly involved in the industrial business.

Reports from Neuilly-sur-Seine, where family decisions are made, concur: Xavier Peugeot has the upper hand, according to several sources who attended internal presentations in November. His approach appeals to some members of the family, who are keen to give the clan a more industrial orientation and strengthen its capital presence, in contrast to the diversification strategy advocated by Peugeot Invest.

Robert, 75, embodies continuity. For him, Filosa's rise to prominence and the ascendancy of former FCA executives are merely a natural pendulum movement after PSA's long domination under Tavares. He believes that skills should take precedence over nationality, and that it is not the role of the Board of Directors to interfere in day-to-day operations. His camp is quick to point out that the governance of a global group cannot be steered by identity-based reflexes, especially in the face of Exor, the leading shareholder with over 15 % of the capital.

Xavier, 60, takes a completely different view. He relies on the reluctance of his brother Thierry, who back in 2014 opposed, unsuccessfully, the recapitalization plan that introduced the French state and the Chinese group Dongfeng to PSA's capital. For the two brothers, the family should have taken advantage of the boom years under Tavares to climb back above 8 %, a threshold that could potentially enable them to claim two seats on the board. They believe it is still possible to exercise this option by buying out Dongfeng's current shareholding, even if Peugeot Invest now favors diversification rather than strengthening its position in Stellantis.

The fear of French obliteration

The appointment of the future Peugeot representative is not just a personal duel: it crystallizes the unease of a clan that already feared losing its influence, and which is now watching Stellantis' center of gravity slide towards Detroit and Turin. Since Filosa took over, a number of strategic functions in Europe, South America, design and operations have been entrusted to executives who had previously worked for FCA. The founding balance of the merger seems to be eroding with each passing month.

In France, questions are multiplying about the Group's industrial future: investments, plant maintenance, product range orientation, distribution of decision-making centers... All subjects on which part of the family feels that the French voice is no longer sufficiently audible. Some of the group's executives share this concern, observing a gradual weakening of the PSA culture in the management bodies. Added to this is a quiet but ongoing rivalry with the Agnelli family. Exor, chaired by John Elkann, retains a decisive influence on Stellantis' strategic orientations. The potential disappearance of Robert Peugeot from the board, combined with the lack of internal consensus on the French side, could further accentuate this imbalance.

A choice that could redefine Stellantis

The stakes therefore go far beyond the question of a mandate. The expected decision, which the family may postpone for a few weeks, will determine the nature of its presence within Stellantis in the years to come. For the first time since the merger, the Peugeots no longer seem aligned on a common strategy. And in the face of Exor, this division could have a lasting effect on France's ability to influence group governance. Filosa, for its part, is pursuing its roadmap without publicly expressing the slightest preference, but everyone knows that a more proactive family representative could weigh in on board discussions in 2026, particularly on future platforms, industrial investments or the distribution of global decision-making centers.

Knowing that the Lancia Ypsilon, Alfa Romeo Junior, Fiat 600, Grande Panda, are all Peugeot derivatives, and of course with PureTech installed in too many Italian models, Peugeot's influence is far too great. The mistake was the creation of Stellantis, which was influenced by the French.

The sooner this page is turned, the sooner the nightmare will end.

Yes, well, without Puretech these Italian models wouldn't exist!

We could have done without the PureTech. And there's always the much better FireFly.

Idiots will dare anything, that's how you can tell.

Without these "Italian Peugeots", Italian brands wouldn't even exist any more, because FCA (i.e. Fiat) had slashed its local industry! So yes, like Opel, I'm not in favor of the systematic use of the rotten 3cyl PSA ... but apart from the fact that the current version is much less "bad" there was unfortunately not much choice to save the brands mentioned! Cqfd.

As for the Peugeot family...well, they're doing what they can at their level, just like all the other shareholders in the end.

Well, let's not get carried away. The project to replace the Panda - based on the Centoventi concept - predates the merger. The same goes for the little Jeep. It was Tavares who changed the projects along the way. As for the PureTech, even "improved" (I use improved in quotation marks advisedly), it still has reliability problems and a very bad reputation.

La nostra industria dell'auto non esiste più. Nessuno ( i governi, l'azionista,i sindacati)l'hanno difesa.

Qui a Torino dopo la fusione praticamente siamo stati ridimensionati come presenza regionale e tutto si é spostato un francia dove c è la parte di maggior controllo sulla parte emea.

Per di più sono state usate tutte piattaforme e motori psa sui marchi ex fca.

Forse c'è sempre stato uno squilibrio evidente di psa su stellantis ma con scarsi risultati visto che ora stellantis vende in europa come la sola fca pre fusione.

Forse bisogna e bisognava Forse non fare questa fusione (per noi italiani si chiama acquisizione) o per lo meno tenere dei motori fca che andavano benissimo meglio dei puretech.

Purtroppo è stata lasciato troppo spazio a finanziari ,non appassionati di auto .

Questo ha svuotato l'Imagine dei marchi , vedere un Alfa o una Lancia con un motore bidone a 3 cilindri non è scusabile ed è quello che ha generato il disastro

Secondo me dopo la grande abbuffata di capitali con Tavares, i francesi ora sono in grande difficoltà perché il loro prodotto è inaffidabile. Sarebbe opportuno che i francesi lasciano STELLANTIS per il bene di noi italiani e loro francesi. Siamo abbastanza bravi da farci una piattaforma da soli. Lo abbiamo sempre fatto. Tecnicamente possiamo solo fare lezioni al mondo intero

Everyone knows that it's the former PSA that supports Stellantis in Europe.

And it's the ex-FCA that keeps Stellantis alive in the rest of the world. And everyone knows it.

Französischer Schrott und italienischer Schrott passt niemals zusammen und Opel geht unter,schade drum.Adam würde sich im Grab umdrehen was aus seinem Schaffen verhackstückt wird.

Der Peugeot Löwe soll bleiben.

Ich bin mit meimem Bravia Kastenwagen Wohnmobil von Peugeot Diesel zufrieden.

Weiter mit den 8 Gang Automaten

Gruss aus der Schweiz

Use only PSA Peugeot Citroen technology, as they are the best for comfort and roadholding. Since the parts will be the same, dealerships can handle more than one brand, such as PSA and Opel and Jeep. If Stellantis does not work as a group, it could be divided based on vehicle size, with the smaller ones using PSA technology, and the rest American. I suggest grooming Xavier Peugeot to be the long term CEO as customers like to see a family member with technical skills and passion over outsiders who come and go.