Last July, the announcement sounded like an admission of failure: the GAC-FCA joint venture, set up in 2011 to open up to Fiat Chrysler, then Stellantisthe doors to the world's largest automotive market, was officially declared bankrupt by the Changsha court. With billion-dollar liabilities and deserted factories, the Chinese dream ended in the courts.

At the time, many saw this liquidation as the end of an adventure begun under Sergio Marchionne, symbolizing the inability of Western automakers to keep pace with China's dazzling electric revolution.

Time to break away...

The joint venture with GAC had everything to succeed on paper: two factories, 300,000 vehicles of annual capacity, and a range calibrated to appeal to Chinese drivers. But after peaking at over 200,000 sales in 2017, the descent was swift. The explosion of local brands, accelerated electrification and the loss of confidence in combustion-powered models spelled doom for the project.

Carlos Tavares, who had tried to regain control after the FCA-PSA merger, came up against a defiant Chinese partner and an increasingly unfavorable regulatory climate. The result: the liquidation of a debt-ridden structure and Stellantis' pitiful exit from a strategic market.

...and that of reconciliation

But six months later, the scene had changed. The departure of Tavares and the arrival of Antonio Filosa at the head of Stellantis marked a clear shift in strategy. Whereas the former CEO advocated a "light asset" approach, staying away from heavy investments in China, his successor seems intent on re-engaging the Group, even if this means reopening badly-healed wounds.

Since taking office in June 2025, Filosa has made a series of gestures towards Beijing, and especially towards Wuhan, Dongfeng's stronghold. In July, barely a month after his appointment, he landed in China surrounded by more than ten top executives, including the world bosses of Peugeot and Citroën, to meet Yang Qing, Chairman of Dongfeng, and the leaders of the Wuhan economic zone. The aim was to "repair the relationship" and lay the foundations for closer cooperation on electric vehicles.

These visits followed one another at the highest level: in February, John Elkann, Chairman of Stellantis and Ferrari, came to China to "take advice" on how to accelerate the group's electrification; in August, Xavier Chardon (Citroën) and Alain Favey (Peugeot) followed suit, closely scrutinizing the local battery and recharging infrastructure ecosystem. A diplomatic ballet that contrasts radically with years of silence and withdrawal.

A new organization that puts China at the center

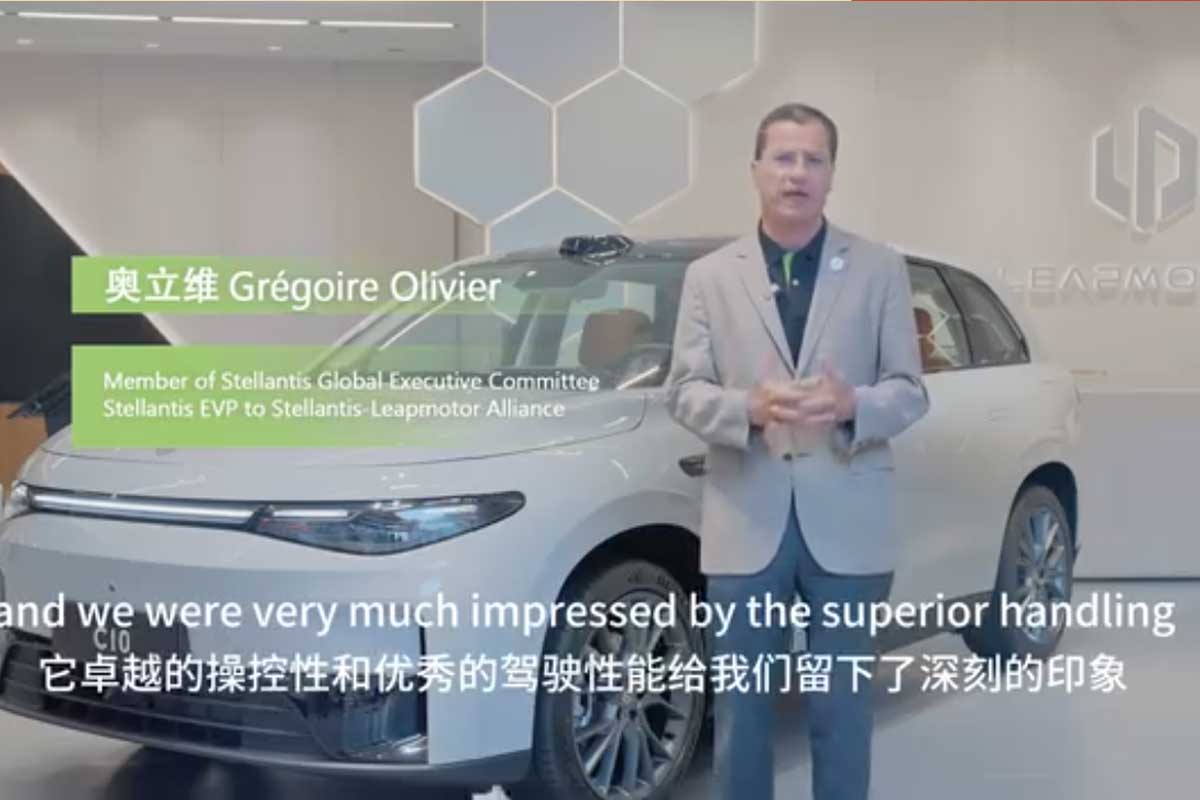

The reorganization announced on October 8, 2025 confirms this strategic shift. Grégoire Olivier, a Group veteran and expert on the Asian market, is now responsible for China and Asia-Pacific, with a seat on the Stellantis Executive Committee. In the same move, Maserati is under the management of Jean-Philippe ImparatoThis is proof that the Group wants both to consolidate its unique ultra-luxury brand and relaunch its image in Asia.

"We need to strengthen our regional focus," insisted Antonio Filosa. In other words: China is no longer just another market, but a pillar of global strategy.

Dongfeng and Leapmotor, a double bet

Stellantis' strategy in China is now twofold. The first is a classic: re-engage with Dongfeng, our long-standing partner, to boost local production and take advantage of Wuhan's solid industrial ecosystem. The second is more daring: to bet on Leapmotor, a Chinese electric start-up in which Stellantis has invested 1.5 billion euros by 2023.

This dual approach - traditional industrial cooperation and innovative technological alliance - could prove fruitful... or sow new ambiguities. Everything will depend on the group's ability to coordinate its efforts and rapidly produce competitive vehicles adapted to local needs.

It's urgent

Because if Stellantis is returning to knock on China's door, it's not just out of a desire to conquer. The figures speak for themselves: in the first half of 2025, the Group's worldwide sales fell by 8 %, turnover by 13 %, and net losses reached 2.3 billion euros. The Group's valuation in Milan has fallen by almost 30 % since the beginning of the year.

In this context, China is no longer just a market to "test", but a possible savior. A place where Stellantis can not only sell, but also learn (batteries, ultra-fast charging, software integration) and bring this know-how back to Europe and America.

It's going to be a long road. Stellantis still has the image of a hesitant manufacturer, whose brands have lost ground with Chinese customers. Rebuilding this trust will require competitive products, strengthened networks and the ability to establish a lasting presence in the local ecosystem.

As one Beijing-based analyst sums up: "The real question is not whether Stellantis returns to China, but whether it can finally become a Chinese automotive player - and not just a passing visitor."

At a time when Stellantis only offers 800V architecture for Maserati in Europe, and when Geely's Zeekr 001 can recharge its large 95kWh battery in 7 minutes with its 900V architecture, there is an urgent need not only to sell in China, but also to continue selling in Europe in the future.

The train is gone! No chance for Stellantis to return to China. There is a plethora of Chinese competition on the spot. Instead, Stellantis needs to reorient itself towards its traditional markets and improve its quality and reliability.

Stellantis has brands with unrivalled expertise (starting with Alfa Romeo) in developing models that are a pleasure to drive, but we mustn't sack these employees. We need to work on lightweight platforms, steering feedback, a stable pedal feel that instills confidence, ergonomics and typical design. In short, we need to remake high-performance European cars with technology on a par with 2026, because roads aren't just straight lines.

This means absolutely nothing! Stellantis has to sell to make a profit. Releasing cars for both open road and racetrack use is a thing of the past, and 99% customers don't give a damn anyway. Alfa Romeo is a brand like all the others from Stellantis, and the brand's own know-how doesn't exist, since there's no development department of its own!

La crisi dell'auto l'hanno creata loro,gli stessi costruttori.

Hanno tolto tutte le offline autorizzate

Che davano un sevizio efficiente e cappillare un numero di vendite importanti.

L'officina era il collante per poter vendere le auto, non c'è momento migliore propporre l'auto NUOVA quando hai la vettura rotta in officina.

PER RISOLVERE IL PROBLEMA AUTO E TUTTA L'ECONOMIA COLLEGATA.

1) RIPRISTINARE TUTTE LE OFFINE AUTORIZZATE DI TUTTI I MARCHI CON ANNESSO SALONE DI ESPOSIZIONE

2) VENDITA E ASSISTENZA PER SINGOLI MARCHI

3) IL PERSONALE OFFINA È VENDITA ALTAMENTE QULIFICATO

4) RIPRISTINARE LE ZONE DEI CONCESSIONARIO SENZA SCONFINAMENTI