The electricity strategy of Stellantis is going through a new period of turbulence in Europe. The cause: persistent industrial difficulties at Automotive Cells Company (ACC), the European joint venture responsible for supplying batteries for the Group's future electric models. To such an extent that some major launches are now threatened with delays of up to eight months, while the plant is currently running far short of its initial targets.

Significant delays for Peugeot, Opel and Citroën

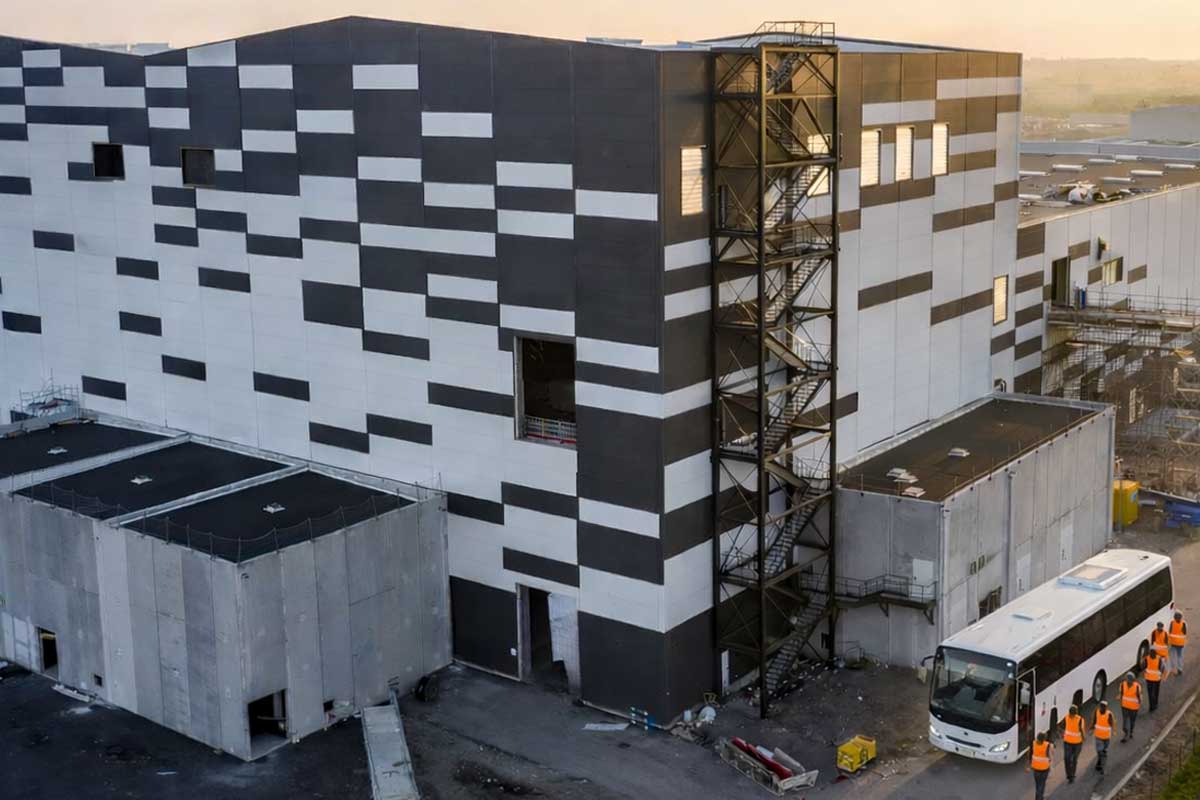

According to information relayed by Bloomberg, the new long-range electric Peugeot 3008 and 5008 are directly affected by ACC's current inability to produce sufficient cells. The problem is not confined to Peugeot: Opel and Citroën are also said to have been forced to postpone the launch of their long-range electric versions. At the root of this situation is a production level well below expectations. The Douvrin plant in northern France currently equips only around 1,000 vehicles a month, a volume far short of the joint venture's initial ambitions.

ACC calls on Chinese know-how

To break the deadlock, ACC has opted for a pragmatic solution: to rely heavily on Asian expertise. 80 Chinese specialists from supplier EVE are already on site, and their number is set to rise to 120 experts in the coming weeks. Their mission is clear: to accelerate ramp-up and reduce the still very high scrap rates of between 15 and 20 %. The stated aim is to triple production by summer 2026, to reach a rate of over 3,000 vehicles per month. A significant step forward, but still insufficient to cover Stellantis' overall needs.

Batteries NMC vs LFP

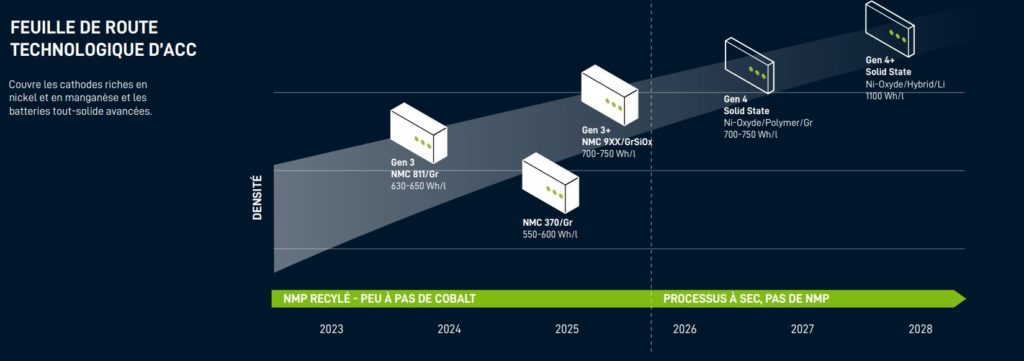

ACC's industrial difficulties also stem from an unfavorable technological context. The joint venture produces NMC (nickel-manganese-cobalt) batteries, while the European market is increasingly moving towards LFP (lithium-iron-phosphate) technology, which is around 20 % cheaper and better suited to current economic constraints. Stellantis has already taken note of this trend. For Europe, the Group has chosen to rely on CATL, with a future gigafactory in Zaragozain Spain, representing an investment of over 4 billion euros. This choice mechanically weakens ACC's strategic role in the Group's battery ecosystem.

Termoli: the gigafactory that never saw the light of day

This loss of influence is also reflected in Italy. Initially, ACC was to transform the historic Termoli site into a battery gigafactory, an emblematic project of the Italian electrification plan. But this project is now considered archived, even if it was never officially abandoned. At the latest Automotive Round Table at Italy's Ministry of Enterprise, Stellantis Europe boss Emanuele Cappellano confirmed that Termoli would ultimately focus on production of e-DCT gearboxes and GSE enginesThis will ensure the site's industrial continuity beyond 2030. An implicit admission: the Italian plant will not produce ACC batteries.

Stellantis and Volkswagen appeal to Brussels

Faced with these structural difficulties, Stellantis is not remaining silent. Antonio Filosa, its CEO, has co-signed a letter to the European Union with Volkswagen boss Oliver Blume. In it, the two executives call on Brussels to defend the European automotive industry, by introducing targeted incentives and a CO₂ bonus reserved for "Made in Europe" electric vehicles.

These delays come at a pivotal time for Stellantis. Under the leadership of Antonio Filosa, the group is thoroughly reviewing its electric roadmap. Several projects have already been scrapped or slowed down, such as the electric Ram 1500 pickup, while some plug-in hybrid versions of the electric Ram 1500 are in the pipeline. are gradually disappearing in North America.