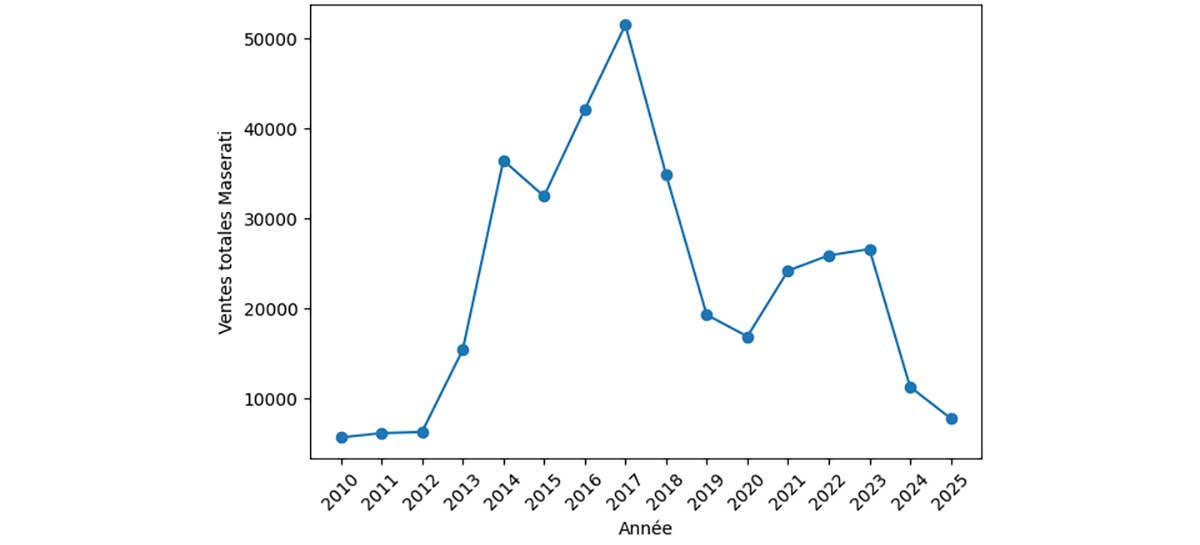

Stellantis has published its results for the fourth quarter of 2025, and they confirm what registrations had already been hinting at for months: Maserati is going through one of the worst sales crises in its modern history. With just 1,900 cars sold in the last quarter, the trident brand ended 2025 at 7,800 units. A figure not seen since the early 2010s, when Maserati was still a niche manufacturer before the Ghibli and Levante era.

The contrast is stark: in 2017, Maserati exceeded 51,000 annual sales. Eight years later, the brand is selling almost seven times fewer cars.

A precipitous fall in three years

The trajectory is all the more striking for being so recent. In 2023, Maserati was still selling 26,600 cars. By 2024, the brand had fallen to 11,300, and by 2025, it had collapsed to 7,800 units. In just two years, Maserati has lost more than two-thirds of its worldwide volumes. The quarterly breakdown confirms the total absence of recovery: 1,700 cars in the first quarter, 2,500 in the second, then 1,700 again and finally 1,900. No sales momentum, no product effect, no year-end rebound. The curve is flat... but at an extremely low level.

This official confirmation gives particular weight to registration data already observed in major markets. The United States, long an absolute pillar of Maserati, has collapsed by more than 40 %. Italy itself is in steep decline, while most European countries are no longer compensating. Even markets traditionally favorable to luxury goods, such as Switzerland and Japan, are plunging.

The symbol of a structural problem

What's striking about these results is not just the decline, but its global nature. Maserati is not suffering from a specific market. The contraction is affecting almost every region of the world at the same time. In other words, this is no longer a simple product cycle. The brand has lost its positioning.

While Maserati is falling, its rivals are evolving in another universe. Ferrari sells slightly fewer cars but boosts profits thanks to highly exclusive models and a value strategy. Lamborghini, despite a reduced range during its product transition, continues to set records around 10,700 annual units.

The end of an industrial model

The 2025 figures probably mark the end of the model established in the 2010s: produce more to make the industrial tool profitable. The Ghibli and Levante had multiplied volumes, but also diluted the brand's image. Today, Maserati finds itself without volume... and without sufficient aura to compensate. Only the Maserati MCXtrema can be an exception.

The new management team led by Jean-Philippe Imparato now wants to produce as closely as possible to demand, drastically reduce inventories and rebuild desirability. A strategy inspired by Ferrari and Lamborghini, but one that requires a profound transformation: range, communication, product consistency and perceived value.

2026-2030: the last chance cycle

With 7,800 sales worldwide, Maserati is almost back to the level of the early 2010s, but in an infinitely more challenging context: electrification, increased competition from luxury cars and the rise of ultra-exclusive brands. The period 2026-2030 will therefore be much more than a simple product plan. It will be a complete repositioning. The brand must become desirable again, even before it becomes profitable again.