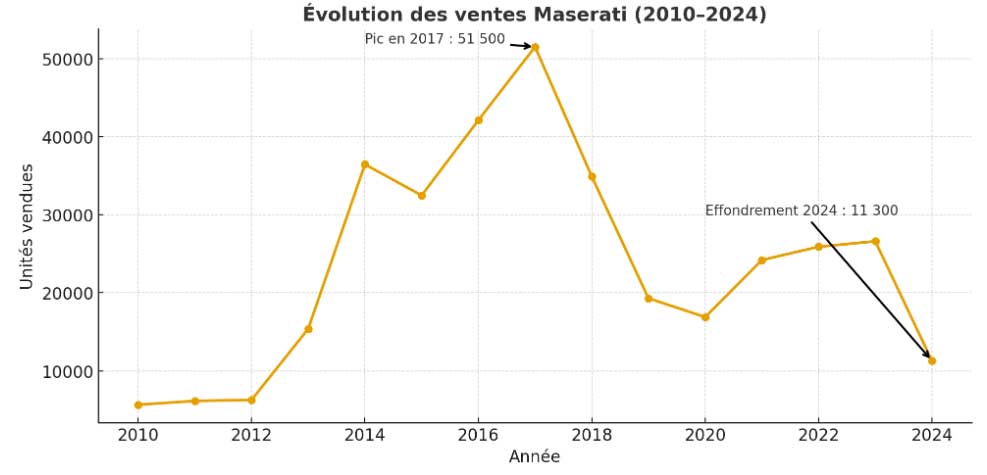

For several months now, the figures have been piling up and the observation remains the same: Maserati is selling fewer and fewer cars. The Trident brand, now under the management of Jean-Philippe Imparato, assumes this scarcity as a strategic choice. But when you look at registration statistics country by country, it's hard not to see a global slowdown... except in one country that is still holding out.

Year 2025 down sharply

From January to October 2025, Maserati registered around 6,442 cars in its main markets. With a few hundred more units expected by the end of the year, the brand should struggle to reach 8,000 worldwide sales, a historically low level, the lowest since 2012.

In the United States, Trident's leading market, the fall was spectacular: -38 % over ten months. Only 2,556 units, compared with over 4,000 during the same period last year. The month of October illustrates this erosion: 124 registrations for Maserati, compared with 244 for Lamborghini and 298 for Ferrari. It's a hard comparison to swallow for a brand that once aspired to play in the same league.

In Italy, Maserati's second-largest market, the decline has reached -25 % with 1,512 units since January. The month of October saw 114 registrations, a low volume for a national brand that is supposed to embody Italian luxury.

The same applies to Japan (-35 %), the UK (-28 %), Switzerland (-42 %), Australia (-28 %) and Turkey (-27 %). Spain, despite a more contained fall of -18 %, remains at modest volumes. Everywhere, the same observation: Maserati is becoming rare. Very rare.

Germany, Trident's unexpected stronghold

The only exception in this gloomy panorama is Germany. With 574 registrations since the start of the year, the country is up +23 %. This performance was driven almost exclusively by the Grecale SUV, which accounted for 39 of the 43 units sold in October. This model, launched to broaden the customer base, seems to have found its audience on the other side of the Rhine. Germany, often perceived as a rational market, paradoxically seems to be breathing new life into the Italian brand, which is far removed from its usual standards.

A strategy now accepted: produce less, but better

Since his arrival at the head of Maserati, Jean-Philippe Imparato has clarified the strategy: the objective is no longer to chase volumes, but to ensure profitability with 15,000 to 20,000 sales per year. In other words, Maserati wants to once again become a rare, exclusive, almost confidential brand, even if this means seeing its figures continue to fall in the short term.

To achieve this, the brand is counting on the extension of the Giorgio platform (which powers the Grecale and GranTurismo), the retention of the Nettuno V6 (soon to be electrified), and production refocused on orders, with much less stock at dealerships. The idea is clear: cut costs, focus on quality, and win back customer confidence.

2026, the year of treading water?

The Maserati industrial plan, shared with the other premium brands of the Stellantis Group, will be presented at the end of the first quarter of 2026. Until then, the brand's only new product will be the Grecale Folgore, the recently upgraded electric versionto maintain a semblance of sales momentum. In other words, 2026 looks set to be a continuation of 2025: a year of stabilization, with no real rebound expected before 2027, and profitability targeted for 2028.

The decline in Maserati sales can now be read from another angle: that of a brand that chooses rarity as its strategy. But there's a fine line between desired exclusivity and commercial collapse.

| Country | January - October 2025 | Change n-1 |

|---|---|---|

| United States | 2556 | -38% |

| Italy | 1512 | -25% |

| Japan | 628 | -35% |

| Germany | 574 | 23% |

| United Kingdom | 300 | -28% |

| Switzerland | 168 | -42% |

| Australia | 236 | -28% |

| Turkey | 159 | -27% |

| Spain | 213 | -18% |

| France | 96 | 26% |

| 6442 | -30% |

PERSONALMENTE ESSENDO GIÀ STATO CONCESSIONARIO MASERATI NON VEDO ASSOLUTAMENTE IL DECLINO DEL MARCHIO DEL TRIDENTE, ANZI, IL MERCATO AUTO TEDESCO, DOCET, PERCHÉ PARLIAMO DI UN MERCATO MOLTO ESIGENTE E RIGOROSAMENTE SETTORIALE CIOÈ PARLIAMO DI DRIVER CHE DISPONGONO DI SUPERVELOCI AUTOSTRADE. CORAZZA DONATO.

If you have money you can afford to have a few cars that break often and it won't be a big deal rotating your Italian and German vehicles to the repair shop . Maserati is losing money sending these cars to Countries who aren't purchasing them in any numbers. It's a Stellantis car with some Stellantis parts on it.

For those of us who lived through the dreaded Detomaso by Biturbo years, the current model lineup is wonderful. My absolute all-time favorite car of all time is the 1967 - 1973. Maserati Ghibli. The Gran Turismo is a lot of car for the money, I think the root of the problem. Is sports cars just don't have a big enough market like they did 40 years ago.

Dal 2019 sono proprietario di Maserati Levante benzina da 430 cv auto con motore spettacolare macinato oltre 250 mila km mai un problema di meccanica o altro sempre tagliandata presso casa madre ogni 20 mila km come da programma auto unica...febbraio 2025 passato alla Seconda Levante 2022 350cv benzina allestimento Gransport che dire non ci sono commenti spero di avere altre Maserati in futuro perché attualmente non saprei scegliere altri marchi...alcune volte leggo commenti vomitevole Maserati non merita questo disprezzo ognuno è libero di scegliere e di volere con le proprie tasche...Maserati merita di più molto di piu....

所有する者としては、故障するのはしょうがないと思うのですが、部品の供給、価格など安価にするべき、何故、車部品なのにマセラティ部品は高価すぎる、維持するのも大変。デザイン、質感など拘りはあって良いと思いますが、それをいつまでも所有できる方向を考えて頂けたらと思います。