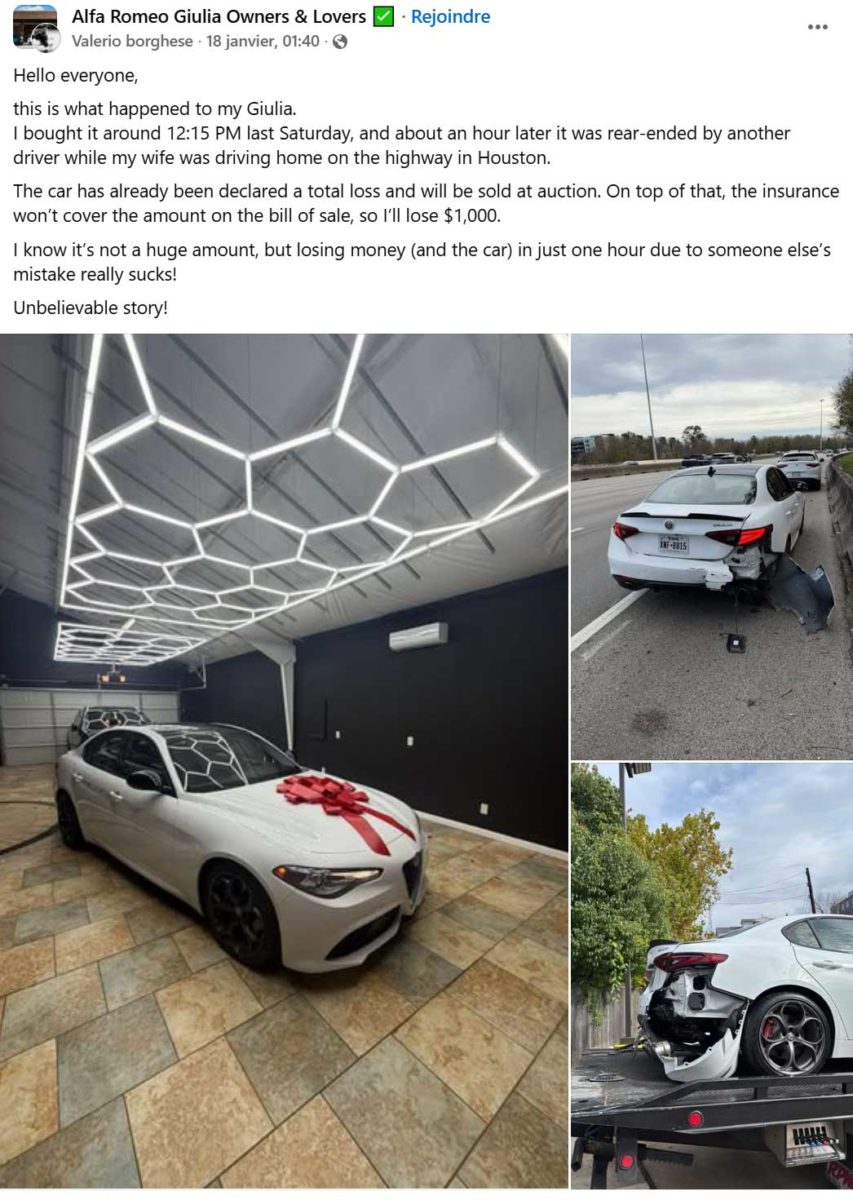

It's the kind of misadventure no Alfiste ever imagines living through, let alone on the day of purchase. A few days ago, in the United States, a Texan owner took delivery of his Alfa Romeo Giulia at around 12:15. An Italian sports sedan, presumably in Veloce trim, still immaculate, symbolically decorated with a red ribbon on the hood, as if to mark an important moment. An hour later, the dream turns to nightmare.

While his wife was driving home on a Houston highway, the Giulia was hit from behind. The impact was violent enough to damage the entire right rear section... but visually far from what many would call irreparable.

"Total loss": the verdict is in

In a message posted on Facebook a few days after the accident, the owner made no secret of his incomprehension and bitterness. The car was quickly inspected and declared a "total loss" by the insurance company. In other words: economically irreparable. Worse still, the compensation offered did not fully cover the amount shown on the purchase invoice. The result: a dry loss of around $1,000. Not a huge sum on its own, but it's a principle that doesn't sit well with anyone. Losing a car and money... in a single hour, due to another driver's mistake.

Wave of incomprehension in the comments

Reaction was swift. Comments poured in by the dozen, and one sentiment dominated: disbelief. For many European Internet users, whether Italian, French, Dutch or Spanish, the Giulia is clearly repairable. Some talk of simple bumper damage, others estimate the bill at between $2,000 and $3,000, or even a little more if sensors or internal components are affected. In Italy, one comment sums up the situation: "Here, it's just a few scratches". Even some insurance and bodywork professionals are openly astonished by the decision. For them, such a claim should never have led to a declaration of total loss.

American logic

But in the USA, the logic is different. Several comments shed a different light: the vehicle is a 2018 model, and the "total loss" decision is based on a purely economic calculation. If the estimated cost of repairs exceeds a certain percentage of the vehicle's value, the insurance company prefers to indemnify and sell the car at auction. Then there's another key element: "salvage" status. By keeping the car and repairing it himself, the owner would have seen his Giulia lose value drastically, while becoming more expensive to insure. A choice that, financially, no longer made much sense in the long term. This is precisely what the owner explains in a subsequent reply: keeping the car would have meant accepting a sharp discount and lasting administrative complications.

Ironically, a number of Internet users from Eastern and Southern Europe are not hiding their interest. Some half-jokingly explain that they would be prepared to buy the Giulia at auction, repair it quickly, and put it back on the road without anyone noticing a thing. A far from fictitious scenario. Every year, many cars declared wrecks in the USA cross the Atlantic to be reconditioned in Poland, Lithuania or Georgia.